Tag Archives: debt

THE GOLD MAGINOT LINE WILL SOON BREAK

As reported many, many times, those of us whom have a sense of “real worth” are converting our fiat into “real money”. Whether you choose gold, silver, platinum, palladium, diamonds, ammo, whiskey or any other good that is easily traded or divisible, we are the ones whom have awakened to the fact that fiat always goes to zero.

Why do 99.9% of investors not own gold? Due to my interest and activity, I clearly meet a higher percentage than the 0.1% who both understand and own gold. But I also meet a lot of people who have …

GLOBAL DEBT IS A PEST THAT MUST BE ERADICATED

October 4, 2018

by Egon von Greyerz

The coming gold and silver surge is guaranteed. It is not a question of IF but only WHEN. Initially, the imminent revaluation of the precious metals will have nothing to do with an investment mania but with the total mismanagement of the world economy. A spectacular rise in the metals is just a reflection of the mess the world is in. But as the paper market fails in gold and silver, there will be panic and manic markets.

So has the Silver Rocket just started? Last week I talked about the coming silver explosion and we could be seeing the beginning of it right now. I have often talked about the Gold-Silver Ratio as the key to the turn up in the precious metals.

GOLD-SILVER RATIO – A LEADING INDICATOR

With bearish divergence on momentum indicators at the critical 80-84 level, it was always a matter of time before the Gold-Silver ratio would break down. When the ratio turns down from an important level, it signifies a turn up in the metals with silver leading the way. As the long term chart below shows, the target for the ratio is 15-30. A return to the historical level of 15 would mean that silver will move up 6x as fast as gold.

If we look at the Weekly chart of the Gold – Silver ratio below, it shows the 4% fall that has taken place in the last 10 trading days. In itself this fall might not seem significant. But the key is the reversal from a very important top area combined with bearish technical indicators. As the chart shows, this ratio can fall very fast once it starts, like the 65% fall in 2010-11 or the 23% fall in 2010.

Read more here.

The Forgotten Money

This is a posting received from an email list I am linked on. Jim Rickards is an outstanding source of knowledge. I recommend his postings.

=================================================

Silver: Once and Future Money

By Jim Rickards

The Roman Republic and the later Roman Empire had gold coins called the aureus and solidus, but they also minted a popular silver coin called the denarius. One denarius was the daily wage for unskilled labor and Roman soldiers.

Of course, in the late Empire, the aureus, solidus and denarius were all debased by mixing the gold and silver with base metals. The decline of the Roman Empire went hand in hand with the decline of sound money.

In the early ninth century AD, Charlemagne greatly expanded silver coinage to compensate for a shortage of gold. This was successful in stimulating the economy of the predecessor of the Holy Roman Empire. In a sense, Charlemagne was the inventor of quantitative easing over 1,000 years ago. Silver was his preferred form of money.

Under the U.S. Coinage Act of 1792, both gold and silver coins were legal tender in the U.S. From 1794 to 1935, the U.S. Mint issued “silver dollars” in various designs. These were widely circulated and used as money by everyday Americans. The American dollar was legally defined as one ounce of silver.

The American silver dollar of the late eighteenth century was a copy of the earlier Spanish Real de a ocho minted by the Spanish Empire beginning in the late sixteenth century. The English name for the Spanish coin was the “piece of eight,” (ocho is the Spanish world for “eight”) because the coin could easily be divided into one-eighth pieces.

Until 2001 stock prices on the New York Stock Exchange were quoted in eighths and sixteenths based on the original Spanish silver coin and its one-eight sections.

Until 1935 U.S. silver coins were 90% pure silver with 10% copper alloy added for durability. After the U.S. Coinage Act of 1965, the silver content of half-dollars, quarters and dimes was reduced from 90% to 40% due to rising price of silver and hoarding by citizens who prized the valuable silver content of the older coins.

The new law signed by President Johnson in 1965 marked the end of true silver coinage by the U.S. Other legislation in 1968 ended the redeemability of old “silver certificates” (paper Treasury notes) for silver bullion.

Thereafter, U.S. coinage consisted of base metals and paper money that was not convertible into silver; (gold convertibility had already ended in 1933).

Let’s hope that the U.S. is not following in the footsteps of the Roman Empire in terms of a political decline coinciding with the substitution of base metals for true gold and silver coinage.

In 1986, the U.S. reintroduced silver coinage with a .999 pure silver one-ounce coin called the American Silver Eagle. However, this is not legal tender although it does carry a “one dollar” face value. The silver eagle is a bullion coin prized by investors and collectors for its silver content. But it is not money.

Who in their right mind would pay a full ounce of silver for goods or services worth only a buck?

In short, silver is as much a monetary metal as gold, and has just as good a pedigree when it comes to use in coinage. Silver has supported the economies of empires, kingdoms and nation states throughout history.

It should come as no surprise that percentage increases and decreases in silver and gold prices denominated in dollars are closely correlated.

Silver is more volatile than gold and is more difficult to analyze because it has far more industrial applications than gold. Silver is useful in engines, electronics and coatings.

Interestingly, gold is used very little other than as money in bullion form. Gold has some highly specialized uses for coating and ultra-thin wires, but these are a very small part of the gold market.

Both gold and silver are used extensively in jewelry. I consider jewelry to be “wearable wealth” and akin to bullion rather than a separate market segment.

Because silver has more industrial uses than gold, the price can rise or fall based on the business cycle independent of monetary considerations. However, over long periods of time, monetary and bullion aspects tend to dominate industrial uses and silver closely tracks its close cousin gold in dollar terms.

While gold and silver prices have a high correlation, the correlation is not perfect. There are times where gold outperforms silver and vice versa. Right now we are in a sweet spot for silver.

Gold is performing well, and silver is performing even better!

The latest data is telling me that silver prices are set to rally. This conclusion is based in part on a bull market thesis for gold.

Gold staged an historic rally from 1999 to 2011, from about $250 per ounce to $1,900 per ounce, a gain of about 900% in that twelve-year span. Since then, gold prices fell in a 50% retracement (using the 1999 base) and bottomed at around $1,050 per ounce in December 2015.

Secular bull and bear market tops and bottoms are difficult to see in real time, but they become apparent with hindsight. Gold gained over 23% in 2016-2017. From the perspective of early 2018, it is clear than the gold bear market ended over two years ago and a new multi-year secular bull market has begun.

Silver is not only along for the ride, it is showing even better performance than gold, albeit with greater volatility. Both the gold and silver rallies are based on a combination of supply/demand fundamentals, geopolitical pressures creating safe haven demand, and increasing inflation expectations as confidence in central banking and fiat money erodes.

In addition, silver has an excellent technical set-up right now. Precious metals analyst Samson Li writing in Thomson Reuters on January 2, 2018 offers this insight in the current technical trading position for silver:

Technically, silver is ripe for a major breakout to the upside in 2018. The CFTC figures Managed Money positions show that COMEX silver has been in a net short for three straight weeks since 12th December. This is not unheard of but is relatively rare for silver; the last time COMEX silver was net short was between the end of June and the first week of August 2015. As investment sentiment can swing from one extreme to another, and given silver’s innate volatility, this net short position should point to the possibility of a sharp short-covering rally. Looking back at the corresponding period in 2015, silver price was trading at $15.61/oz on the 7th July, and it was the third consecutive week recording a net short position. Approximately a year later, silver was trading over $20/oz in July 2016… [T]he current poor sentiment does suggest that silver could be one of the better performing precious metals in 2018, barring any crisis that could trump most of the commodities but gold.

The good news is that this secular rally in silver is in its early days. Recent gains will be sustained and amplified in the months and years to come.

Silver will outperform gold in the short-run, and shares in well-managed silver mining companies will do even better than silver.

Regards,

Jim Rickards

Is anyone in the GOP watching the deficit?

Where is the resolve to stop spending and increasing the tax burden of Americans? We are allowing the special interests to pad their vaults with our tax money. So, in order to pass tax reform, it is necessary to increase the spending and the deficit, I say keep your tax reform. If we Americans are forced to spend within our limits, whether that be our credit limit or even our income limit, then Congress must do the same.

“Conservative leaders would have slammed this Big-Government Budget under Pres. Obama. Now, they demand Republicans in Congress vote for it,” tweeted Rep. Justin Amash (R-Mich.). “2011-2016: Principles! 2017: End justifies the means.”

Source: Is anyone in the GOP watching the deficit? – Personal Liberty®

Americans Seen “Flirting With Financial Disaster” As 2Q Credit Card Debt Soars Back To 2008 Highs

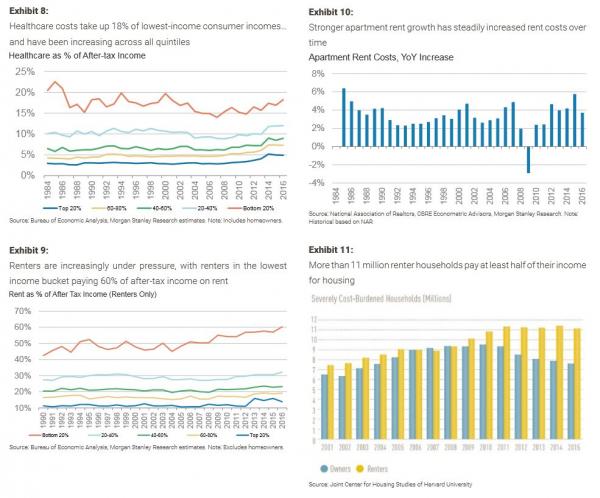

When I see these numbers in conjunction with the “current debt” now exceeding $20 Trillion, I pause to reflect on why I started converting my FRN’s to hard assets like gold and $ilver. The most applicable reason, gold and $ilver are unencumbered. Meaning, that I own it, no one has any claim to it. Remember that FRN’s (Federal Reserve Notes) are just that, notes. Promises to pay.

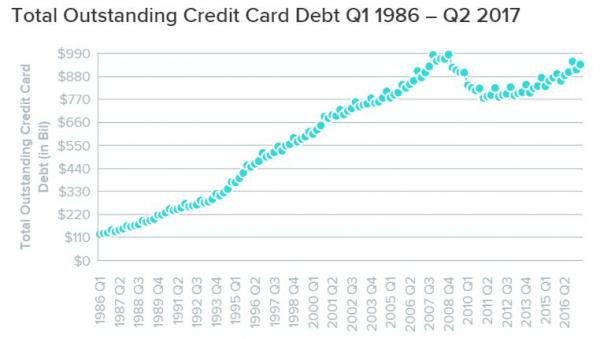

“With credit card data in for Q2 2017, American households look to once again be on a collision course with the ever-elusive $1 trillion goal that narrowly escaped their clutches in 2008. With nearly $940 billion in credit card debt outstanding, 2Q 2017 marked the second highest consumer revolving debt balance since the previous peak in 2008. Per WalletHub:

All of which adds up to nearly $8,000 of credit card debt per household, up 5% YoY versus flat-ish wages. Of course, the more surprising component of the 2Q 2017 credit card data is not that banks continue to trip over one another for the ‘opportunity’ to underwrite Americans’ purchases of fidget spinners, but rather that they continue to do so despite the rather ominous recent rise in charge-offs.”

With credit card data in for Q2 2017, American households look to once again be on a collision course with the ever-elusive $1 trillion goal that narrowly escaped their clutches in 2008.

Source: Americans Seen “Flirting With Financial Disaster” As 2Q Credit Card Debt Soars Back To 2008 Highs

Senate Bill to Force Citizens to Register Cash Not in a Bank, Violators Get 10 Years in Prison

As if the government wasn’t in our lives enough already. We, the people of the United States, seem to forget that our Constitution limits our governance. Where is it in the Constitution that it even allows the government to print money. Money that is backed by nothing. Our founders had the foresight to allow only coined, Gold and $ilver. This bill should not get out of committee. So unconstitutional.

A new bill requires US citizens to declare ALL assets in excess of $10,000 — or have the entirety of their accounts and assets seized, and spend ten years in prison.

Source: Senate Bill to Force Citizens to Register Cash Not in a Bank, Violators Get 10 Years in Prison

The real reasons why Trump has flipped on his campaign promises

His campaign to drain the swamp has fallen to the wayside. The progressives are still in control and we are falling further into debt. We have to plummet him with reminders that “We the People” demand he honor his pledges. As I posted in the past, Trump Administration turning out to be the Goldman Sachs Administration, the Goldman influence is driving the administration. While he has done some good, he is still bringing in refugees, hasn’t built the wall, allowed the Generals to bomb Syria (a false flag), we still have obamacare and now we are about to have $1 trillion in spending, short term at that. Yes, $1 trillion, with a “T”.

WAKE this guy up.

Demand that he return the budget bill

Stop refugees

Stand tall for the wall

Trump, at the very onset of his administration, broke one of his most important campaign promises — to “drain the swamp.” Instead, he filled his cabinet with all of the same swamp creatures he originally attacked; the same swamp creatures Hillary Clinton was notorious for serving.

Source: The real reasons why Trump has flipped on his campaign promises – Personal Liberty®

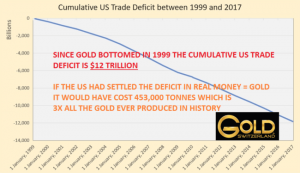

THE US OWES THE WORLD 3x THE GOLD EVER PRODUCED

If you have been following me at all you must know that I am an advocate for regular accumulation of “REAL MONEY”, gold and $ilver.  What that means is that you continue to convert your dollars into bullion, preferably recognizable coins, on a regular schedule. Whether you choose weekly, monthly, quarterly or even daily, JUST DO IT! As the following article so elegantly describes the coming demise of the dollar, it will be clear why I advocate this.

What that means is that you continue to convert your dollars into bullion, preferably recognizable coins, on a regular schedule. Whether you choose weekly, monthly, quarterly or even daily, JUST DO IT! As the following article so elegantly describes the coming demise of the dollar, it will be clear why I advocate this.

Gold and silver uptrend has resumed. Gold has partially reflected the currency money printing and debasement since 1971 by going up 35x. Silver is only up 10x since then. The principal reason for the relatively small rises in gold and especially silver is the constant manipulation and suppression in the paper market. Without that both gold and silver would be many times higher than the current prices. But the paper market can fail at any time and once it does, there will be a price explosion in physical gold and silver whilst the paper metals will become worthless.

COMEX PHYSICAL GOLD DELIVERIES RISE 729% YEAR OVER YEAR!

Looks good for a large move higher with the amount of contracts standing for delivery. If you have been following my advise and accumulating gold and $ilver monthly, you will be rewarded greatly. You, we, have been acquiring non-counter party risk assets at lower multiples. Remember, when the metals move, it is the amount of ounces or grams that you have vs the price. Consider starting today if you haven’t yet. Here is a great way to accumulate on a regular basis.

Written by: Avery B. Goodman (01/29/2017) The price of gold has been generally following the predictions I made on December 9, 2016. So far, so good… A lot of non-connected hedge funds and…

Source: COMEX PHYSICAL GOLD DELIVERIES RISE 729% YEAR OVER YEAR!