When I see these numbers in conjunction with the “current debt” now exceeding $20 Trillion, I pause to reflect on why I started converting my FRN’s to hard assets like gold and $ilver. The most applicable reason, gold and $ilver are unencumbered. Meaning, that I own it, no one has any claim to it. Remember that FRN’s (Federal Reserve Notes) are just that, notes. Promises to pay.

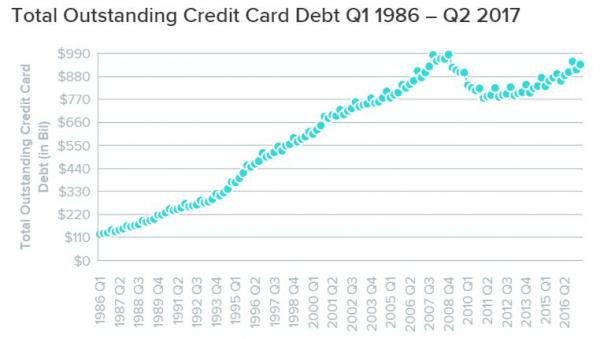

“With credit card data in for Q2 2017, American households look to once again be on a collision course with the ever-elusive $1 trillion goal that narrowly escaped their clutches in 2008. With nearly $940 billion in credit card debt outstanding, 2Q 2017 marked the second highest consumer revolving debt balance since the previous peak in 2008. Per WalletHub:

All of which adds up to nearly $8,000 of credit card debt per household, up 5% YoY versus flat-ish wages. Of course, the more surprising component of the 2Q 2017 credit card data is not that banks continue to trip over one another for the ‘opportunity’ to underwrite Americans’ purchases of fidget spinners, but rather that they continue to do so despite the rather ominous recent rise in charge-offs.”

With credit card data in for Q2 2017, American households look to once again be on a collision course with the ever-elusive $1 trillion goal that narrowly escaped their clutches in 2008.

Source: Americans Seen “Flirting With Financial Disaster” As 2Q Credit Card Debt Soars Back To 2008 Highs