Half the world to dump U.S. dollars in future, causing ‘tsunami of inflation’ and asset price ‘collapse’, paving the way for CBDCs and The Great Reset – Andy Schectman | Kitco News

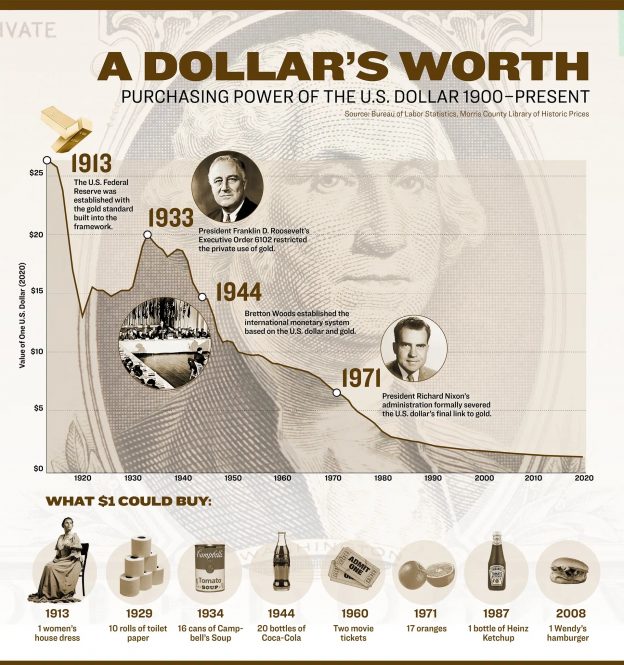

“As the world moves away from the U.S. dollar as a world reserve asset, dollars will be dumped globally, causing a “tsunami of inflation” in the United States as the currency returns to American shores. Interest rates will rise accordingly, followed by a “collapse” in asset prices, which would be used to usher in Central Bank Digital Currencies (CBDCs) and The Great Reset.

This dire scenario is the forecast of Andy Schectman, President and Owner of Miles Franklin and an expert on monetary and economic history. Schectman, who has three decades of experience in the precious metals sector, said that the BRICS (Brazil, Russia, India, China, and South Africa) coalition could lead the charge to develop their own reserve currency which would compete against the U.S. dollar.

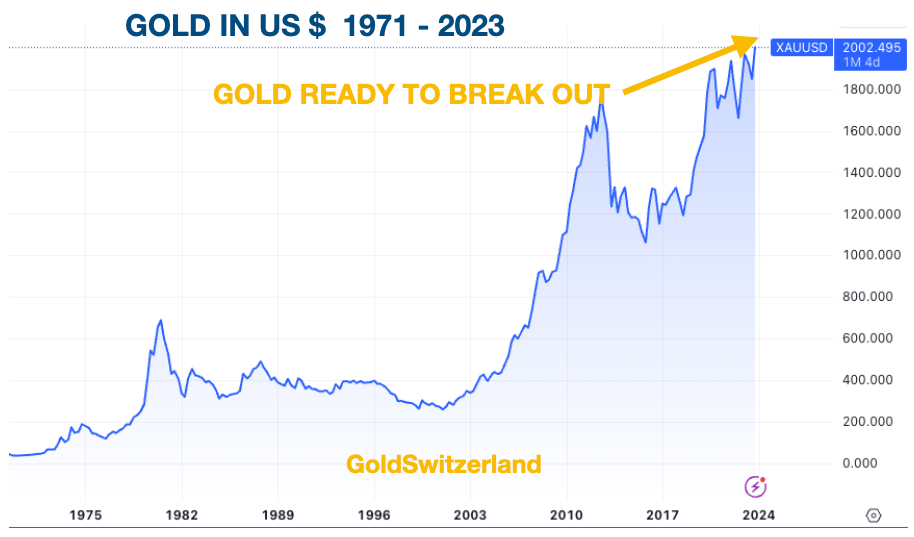

“The BRICS are, I think, coalescing against the dollar, the perceived hypocrisy and hegemony of the dollar,” he said. “We’ve already been told that the BRICS currency would be pegged to gold or to commodities, the assumption being that gold is one of the commodities.”

The BRICS are meeting in Durban, South Africa in August, and one of their agenda items is the development of an alternative to the U.S. dollar.

Schectman told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, that the dollar’s “weaponization” during the Russian war with Ukraine has hastened the move to “dump” dollars. He suggested that Western sanctions on Russia, as well as expelling Russia from the SWIFT payment system, has had a chilling effect, deterring other nations from using the dollar.

“Since the weaponization of the dollar in 2022, it [de-dollarization] seems to be spinning much, much faster,” Schectman observed.

He pointed to Saudi Arabia, who has recently stated that it is open to accepting other currencies in exchange for its oil, as a potential catalyst for massive de-dollarization.”