Andy Schectman, an American Patriot, who’s not afraid to expose the truth of modern day manipulation of the financial system. Lot’s of great information here, that you who follow me will be amazed of the confirmation.

Andy Schectman, an American Patriot, who’s not afraid to expose the truth of modern day manipulation of the financial system. Lot’s of great information here, that you who follow me will be amazed of the confirmation.

Yes indeed, the only periodic element that is easily divisible, non-corrosive and soft enough to be molded or coined. Once it is in your possession, it is an unencumbered asset.

Be sure to get yours before the onslaught and coming demise of the Federal, no more Federal than Federal Express, Reserve Notes.

I think most of you reading this right now are aware that gold is unlike any other metal, certainly any other element. It doesn’t play by the same rules as iron or tin or aluminum, and its value has nothing to do with its utility—or lack thereof. People valued the yellow metal for its beauty and malleability eons before they knew of its usefulness in conducting electricity or its chemical inertness.

Source: Gold Was Chemically Destined To Be Money All Along | Gold Eagle

Written by: Avery B. Goodman (01/29/2017) The price of gold has been generally following the predictions I made on December 9, 2016. So far, so good… A lot of non-connected hedge funds and…

Source: COMEX PHYSICAL GOLD DELIVERIES RISE 729% YEAR OVER YEAR!

Did you know that the United Nations formed the International Monetary Fund (IMF)? Did you know they were formed to stop the use of Gold and precious metals, thus allowing the infinite creation of fiat? The destruction of OUR dollar?

With the founding of the United Nations after World War II, representatives of 44 nations met in conference at Bretton Woods, N.H., in July 1944, to form the International Monetary Fund. The IMF is a specialized agency affiliated with the United Nations, designed to stabilize international monetary exchange rates instead of the gold standard. It has no power to dictate national monetary policies. The members of the IMF, it was decided, would all deposit quotas in the fund, only one-quarter of which had to be in gold, and the rest in their own currencies. From this fund, members could purchase with their own national currencies the gold or foreign exchange they needed. The IMF, then, became the world’s largest source of quickly available international credit. By June 1972, the 124-nation fund had provided $24.6 billion in short-term financial assistance.

Source: IMF formed after gold standard abandoned: Precious metals basics

When the paper traders of precious metals realize there is no escape from the finite amount of gold and other metals available, the price will be the moon. The “World Banking Cartel” has to keep their money machines cranking out US Dollars in order to justify their house of cards.

When the paper traders of precious metals realize there is no escape from the finite amount of gold and other metals available, the price will be the moon. The “World Banking Cartel” has to keep their money machines cranking out US Dollars in order to justify their house of cards.

See the lessons learned during the last few financial crisis and the Central Bank response. Also see the value of physical gold and $ilver vs the financial instruments they wish us to believe in. The final demise is approaching very quickly…

As The World Economy Is Burning Central Bankers Are CluelessBy Egon von Greyerz The more things change, the more they stay the same. The financial world loves focusing on some future event that the…

Source: As The World Economy Is Burning Central Bankers Are Clueless | GoldSwitzerland

Conclusion: Such times as these when central banks lose control over their money manipulations do not come often. But they have arrived. Involve yourself as you wish. You may strike gold.

Source: Gold: Glittering Choice Whether Interest Rates Go Up or Down | The Daily Bell

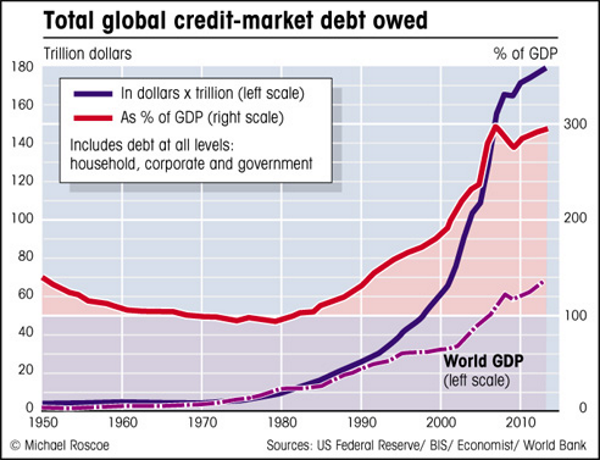

When the amount of debt rises, as significantly as it has, that is when you know there is a coming financial tsunami. This will be worse than any black swan event of recent time. The central bankers bank, the Bank of International Settlement (BIS), has fueled and fooled the world into believing they are in control. Just look at this chart of debt..

Central Bankers Put Ponzi And Madoff To Shame By Egon von Greyerz Charles Ponzi must be turning in his grave! His pyramid scheme in 1920 guaranteed returns of 50% in 50 days and 100% in 100 …

Source: Central Bankers Put Ponzi And Madoff To Shame | GoldSwitzerland

According to Bloomberg and other sources, the International Monetary Fund is expected to announce a reserve currency alternative to the U.S. dollar on October twentieth of this year, which experts say will send hundreds of billions of dollars moving around the world, literally overnight. This announcement is expected to trigger one of the most profound transfers of wealth in our lifetime. Bloomberg reports that this decision comes on the heels of China pushing for their own currency to be elevated to reserve currency status. So if you want to protect your savings & retirement, you better get your money out of U.S. dollar investments and into the one asset class that rises as currencies collapse.

Source: The IMF Threatens to Kill the U.S. Dollar – Wholesale Direct Metals

Today the man who has become legendary for his predictions on QE, historic moves in currencies, and major global events warned King World News that the U.S. launch of QE-IV this year is going to trigger a frightening bond and currency collapse, hyperinflation and skyrocketing gold and silver.