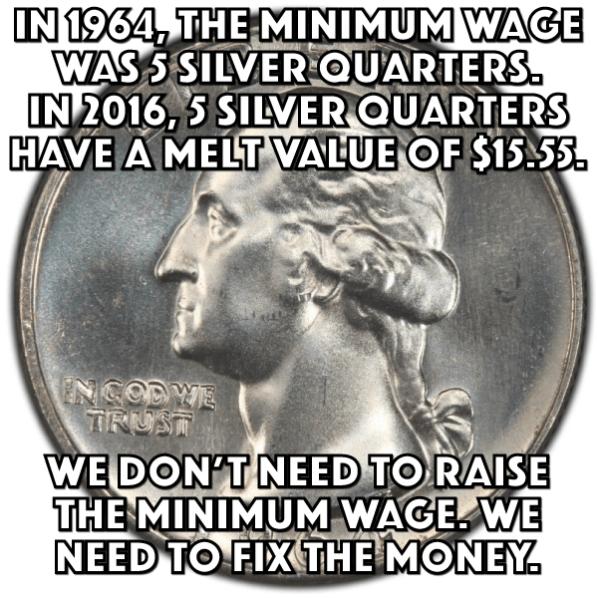

It has been said many times throughout history that whomever controls the money controls the people. We have been destroyed by the so called Federal Reserve. No more “Federal” than Federal Express. A private corporation formed in secret and passed by the US Congress in the thinly attended December holiday session. When will they over turn it? Well, just like we hear the Trump-Pence saying, the good old boys are the issue. Our only hope is gold and $ilver, the “REAL” money. Remember “Money is Debt”. Holding gold and $ilver are unencumbered assets.

There’s been some talk on the campaign trail about the “national debt.” Mike Pence stated that the national debt has doubled under President Barack Obama. But what does the “national debt” really mean and is it something we need to worry about?

Source: Don’t worry about the ‘national debt’ – Personal Liberty®