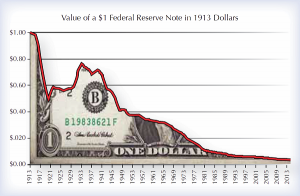

So you think it can not happen to the USD? Well it happens all the time to fiat currency. Especially fiat that is backed by nothing but credit and promises to pay. Our curse is that the USD is the world reserve currency. So when the music stops where do you think ALL those dollars go? Like cattle and sheep at night, they come home. Remember the wheelbarrows in Germany?

According to Bloomberg and other sources, the International Monetary Fund is expected to announce a reserve currency alternative to the U.S. dollar on October twentieth of this year, which experts say will send hundreds of billions of dollars moving around the world, literally overnight. This announcement is expected to trigger one of the most profound transfers of wealth in our lifetime. Bloomberg reports that this decision comes on the heels of China pushing for their own currency to be elevated to reserve currency status. So if you want to protect your savings & retirement, you better get your money out of U.S. dollar investments and into the one asset class that rises as currencies collapse.

Source: The IMF Threatens to Kill the U.S. Dollar – Wholesale Direct Metals