Not only do we have peak oil but also peak gold. So the world is facing a vicious a cycle of increasing energy costs leading to higher costs of extracting precious metals and other commodities.

This confirms that high inflation is here to stay, leading to higher interest rates and very high risk of debt defaults within the private and sovereign sectors.

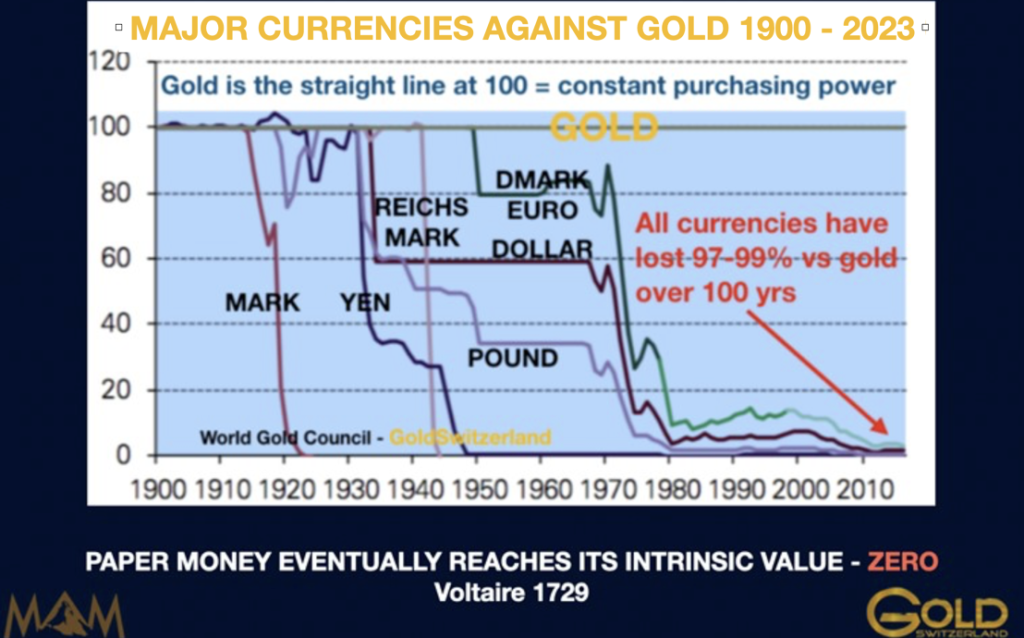

To hold US dollars is to hand your wealth to the state which is likely to either debase it, lose it, spend it, confiscate it or misappropriate it in any other way.

Why would anyone trust a government like the US which currently is doing all of the above things.

And don’t believe that the Euro will fare better.

The only way to be in control of your own money is to hold it in physical gold outside your country of residence in private vaults.

The trust in the US and the dollar is now coming to an end after the confiscation of all Russian assets. Who would want to hold their assets under the control of a government what can just steal it at will.

So we are not facing a dollar crisis. Instead, the dollar and its issuer is the crisis. No one who is worried about preserving his wealth would ever consider holding it in a crisis currency, controlled by a crisis government.

I find it fascinating that the JP Morgan who has become a joint custodian of the GLD gold ETF is planning to move the gold to Switzerland. This confirms my strong view that Switzerland will further strengthen its position as a major gold hub. Currently 70% of all the gold bars in the world are refined in Switzerland which also have more major private gold vaults than any other country.

Also, as I discussed in a recent article, no central bank will want to hold its reserves in US dollars with to a capricious US government that can steel it at will. The only money that could mantle the role as a reserve asset as the dollar fades away is obviously gold.

See more here: MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT – Matterhorn – GoldSwitzerland